Is There A Property Tax In Tennessee . local government officials collect property taxes. The average property tax rate is. Median property tax is $933.00. 96 rows — tennessee : comptroller of the treasury. — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. In memphis, tennessee’s most populous city, rates are double the state average. The tennessee comptroller of the treasury's property assessment web. Low property taxes aren’t uniform across the state, however. This interactive table ranks tennessee's counties by median property. the median annual property tax payment in tennessee is just $1,220, about half the national average. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435.

from www.formsbank.com

96 rows — tennessee : comptroller of the treasury. This interactive table ranks tennessee's counties by median property. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. Low property taxes aren’t uniform across the state, however. The tennessee comptroller of the treasury's property assessment web. the median annual property tax payment in tennessee is just $1,220, about half the national average. local government officials collect property taxes. The average property tax rate is.

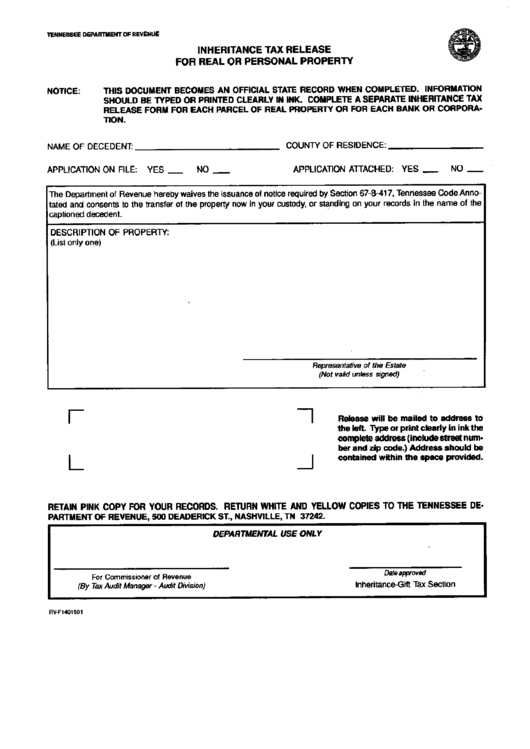

Inheritance Tax Release For Real Or Personal Property Form Tennessee

Is There A Property Tax In Tennessee — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. The tennessee comptroller of the treasury's property assessment web. comptroller of the treasury. — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. In memphis, tennessee’s most populous city, rates are double the state average. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. local government officials collect property taxes. Low property taxes aren’t uniform across the state, however. the median annual property tax payment in tennessee is just $1,220, about half the national average. 96 rows — tennessee : This interactive table ranks tennessee's counties by median property. Median property tax is $933.00. The average property tax rate is.

From www.formsbank.com

Application Form For Property Tax Exemption Tennessee State Board Of Is There A Property Tax In Tennessee This interactive table ranks tennessee's counties by median property. comptroller of the treasury. local government officials collect property taxes. — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. 96 rows — tennessee : The tennessee comptroller of the treasury's property assessment. Is There A Property Tax In Tennessee.

From www.zrivo.com

Tennessee Property Tax Is There A Property Tax In Tennessee 96 rows — tennessee : The average property tax rate is. Low property taxes aren’t uniform across the state, however. The tennessee comptroller of the treasury's property assessment web. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. comptroller of the treasury. local government officials. Is There A Property Tax In Tennessee.

From www.icsl.edu.gr

When Are Property Taxes Due In Tennessee Is There A Property Tax In Tennessee the median annual property tax payment in tennessee is just $1,220, about half the national average. The tennessee comptroller of the treasury's property assessment web. Median property tax is $933.00. Low property taxes aren’t uniform across the state, however. 96 rows — tennessee : comptroller of the treasury. In memphis, tennessee’s most populous city, rates are double. Is There A Property Tax In Tennessee.

From www.city-data.com

Why is TN property tax so high? Tennessee Page 16 CityData Forum Is There A Property Tax In Tennessee 96 rows — tennessee : the median annual property tax payment in tennessee is just $1,220, about half the national average. In memphis, tennessee’s most populous city, rates are double the state average. comptroller of the treasury. Low property taxes aren’t uniform across the state, however. — real estate taxes vary by municipality across tennessee, with. Is There A Property Tax In Tennessee.

From www.youtube.com

Tennessee Property Tax Relief Program YouTube Is There A Property Tax In Tennessee — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. Low property taxes aren’t uniform across the state, however. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. The average property tax rate. Is There A Property Tax In Tennessee.

From www.youtube.com

Cleveland TN raising property taxes YouTube Is There A Property Tax In Tennessee In memphis, tennessee’s most populous city, rates are double the state average. comptroller of the treasury. Median property tax is $933.00. The tennessee comptroller of the treasury's property assessment web. This interactive table ranks tennessee's counties by median property. The average property tax rate is. — here are the typical tax rates for a home in tennessee, based. Is There A Property Tax In Tennessee.

From www.tennessean.com

Property taxes Tennessee should enact a cap to protect all residents Is There A Property Tax In Tennessee — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. local government officials collect property taxes. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. This interactive table ranks tennessee's counties by median property. —. Is There A Property Tax In Tennessee.

From www.youtube.com

பிற மாநிலங்களை விட தமிழ்நாட்டில் சொத்து வரி குறைவு கே.என். நேரு Is There A Property Tax In Tennessee Low property taxes aren’t uniform across the state, however. This interactive table ranks tennessee's counties by median property. 96 rows — tennessee : — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. In memphis, tennessee’s most populous city, rates are double the state. Is There A Property Tax In Tennessee.

From tennesseecentral.org

Taxes and Incentives for Tennessee Central Economic Authority Is There A Property Tax In Tennessee Low property taxes aren’t uniform across the state, however. local government officials collect property taxes. 96 rows — tennessee : — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. Median property tax is $933.00. — by understanding how property taxes affect. Is There A Property Tax In Tennessee.

From infra.economictimes.indiatimes.com

Tamil Nadu Property Tax TN govt effects property tax revision after 24 Is There A Property Tax In Tennessee comptroller of the treasury. — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s assessed value in 2021,. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. local government officials collect property taxes. In memphis,. Is There A Property Tax In Tennessee.

From www.reddit.com

Property tax TN r/VeteransBenefits Is There A Property Tax In Tennessee — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. In memphis, tennessee’s most populous city, rates are double the state average. comptroller of the treasury. The tennessee comptroller of the treasury's property assessment web. the median annual property tax payment in tennessee is just $1,220, about. Is There A Property Tax In Tennessee.

From www.youtube.com

Tennessee Tax Sales Redeemable Tax Deeds YouTube Is There A Property Tax In Tennessee Median property tax is $933.00. In memphis, tennessee’s most populous city, rates are double the state average. comptroller of the treasury. The average property tax rate is. This interactive table ranks tennessee's counties by median property. Low property taxes aren’t uniform across the state, however. the median annual property tax payment in tennessee is just $1,220, about half. Is There A Property Tax In Tennessee.

From www.titlegroupoftn.com

Understanding Property Taxes What Homeowners Need to Know Before Year Is There A Property Tax In Tennessee 96 rows — tennessee : local government officials collect property taxes. Median property tax is $933.00. In memphis, tennessee’s most populous city, rates are double the state average. This interactive table ranks tennessee's counties by median property. — real estate taxes vary by municipality across tennessee, with an average tax rate of 0.67 percent of a home’s. Is There A Property Tax In Tennessee.

From www.youtube.com

PROPERTY TAXES IN TENNESSEE EVERYTHING YOU NEED TO KNOW YouTube Is There A Property Tax In Tennessee This interactive table ranks tennessee's counties by median property. 96 rows — tennessee : The average property tax rate is. In memphis, tennessee’s most populous city, rates are double the state average. the median annual property tax payment in tennessee is just $1,220, about half the national average. Median property tax is $933.00. local government officials collect. Is There A Property Tax In Tennessee.

From exouzacfu.blob.core.windows.net

Hawkins County Tennessee Property Tax Records at Delores Humphrey blog Is There A Property Tax In Tennessee local government officials collect property taxes. The tennessee comptroller of the treasury's property assessment web. In memphis, tennessee’s most populous city, rates are double the state average. This interactive table ranks tennessee's counties by median property. — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. Low property. Is There A Property Tax In Tennessee.

From www.semashow.com

Property Tax Sales Memphis Tn Is There A Property Tax In Tennessee — by understanding how property taxes affect your home purchase, knowing key factors that influence rates, and being aware of. Median property tax is $933.00. the median annual property tax payment in tennessee is just $1,220, about half the national average. Low property taxes aren’t uniform across the state, however. The average property tax rate is. In memphis,. Is There A Property Tax In Tennessee.

From www.youtube.com

Tennessee State Taxes Explained Your Comprehensive Guide YouTube Is There A Property Tax In Tennessee Median property tax is $933.00. This interactive table ranks tennessee's counties by median property. — here are the typical tax rates for a home in tennessee, based on the typical home value of $321,435. 96 rows — tennessee : the median annual property tax payment in tennessee is just $1,220, about half the national average. The average. Is There A Property Tax In Tennessee.

From www.tnmobilehomebuyer.com

How Much is Property Tax on a Mobile Home in Tennessee TN Mobile Home Is There A Property Tax In Tennessee The tennessee comptroller of the treasury's property assessment web. comptroller of the treasury. Low property taxes aren’t uniform across the state, however. In memphis, tennessee’s most populous city, rates are double the state average. the median annual property tax payment in tennessee is just $1,220, about half the national average. Median property tax is $933.00. The average property. Is There A Property Tax In Tennessee.